Impact of Cloud Data Platform: Success Stories from Cloudera

What is Cloudera?

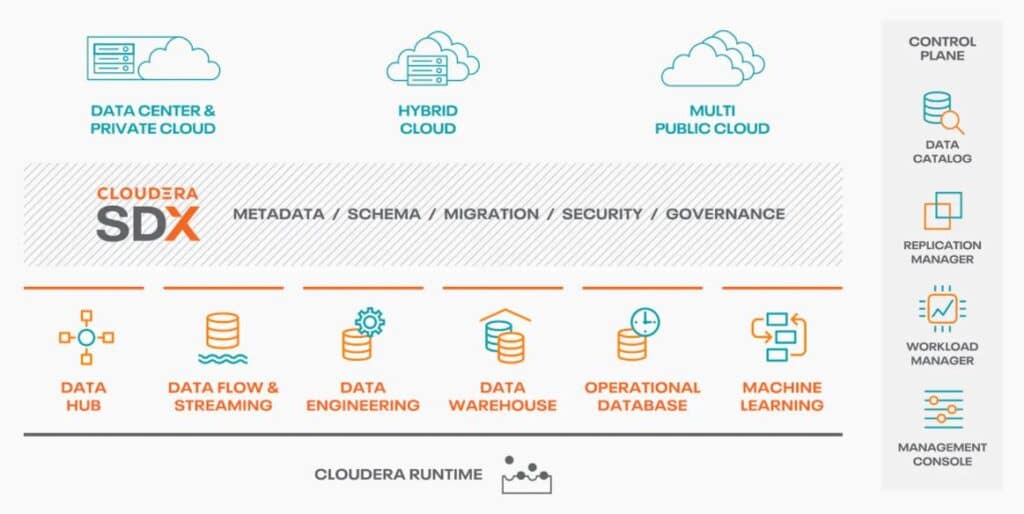

Cloudera is a software platform that provides enterprises with data management run on cloud or on premises. That is, a single place to store, process, and analyze all their data. This enables them to increase the value of their existing investments while opening up fundamentally new ways to create value from their data.

Cloudera products can be used to achieve better performance and prevention of proactive issues. These include data hub, data engineering, data warehouse, machine learning, and CDP private cloud.

In this article, we review several success stories by Cloudera to better understand what it is, and the kind of bottom line results it could drive for organizations. A full list of Cloudera’s customers ranging across industries can be found HERE.

- Development Bank of Singapore (DBS) – Leading bank in Asia recognised for its high credit rating and digital capabilities

- Deutsche Telekom – Largest telecommunications provider in Europe supplying services to over 150 million customers worldwide

- Hilton – One of the oldest hospitality chains in the world with over 5,500 hotels across 14 brands

- MasterCard – Offers the world’s fastest payment processing network that simplify, secure, and enhances commerce activities

- Novantas – Leading provider of analytical, advisory services and technology solutions for financial institutions

- Octo Telematics – World’s leading provider of telematics and data analytics solutions for the auto insurance industry

1. The Development Bank of Singapore (DBS) Continues Their Commitment Towards a Customer-Centric Banking Experience by Leveraging Data Insights, Resulting in 80% Operating Costs Reduction

DBS’s Challenges

To continually deliver top customer experience, DBS understood the need for more customer-data. Their current infrastructures, which were not revealed, were costly to scale and heavily limited in its capability to support analytics.

DBS’s Solutions

A cloud data platform powered by a specialised team enables DBS to collect all sorts of different data in their customers’ touchpoints and along their buying journey. Among which, their data hub utilises the technologies of Cloudera, such as the Navigator, encased together with other infrastructures. Thus, DBS’s team could explore and trial innovative solutions that transform their services positively.

DBS’s Results

1. Better Service Delivery Enabled by Predictive Decision-Making

Organisational-wide commitment towards data analysis and understanding makes the company ‘know’ before happening. Additionally, the company were able to collect and use data from all within the organisation, not just customer-related data. Hence, synergy between departments from ‘knowing’ their customers contributed to the delivery of their service enhancement too!

2. 80% Savings in Overall Operating Costs

As previously mentioned, data collected not only helped the Customer Service and Experience teams. Across departments from HR, Audit, Risk Management, to the operational staffs, data were used to improve their own department and branch needs! Customer traffic, ATM queues, and call centre volume; you name it! Improvements right across the organisation had seen a huge 80% savings in operating costs! Way to better banking!

3. Increase in Revenue While Decreasing Costs of Servicing Customers A slight spin-off to the second point, improvements to servicing cuts certain costs. Additionally, better service in DBS had meant better delivery of certain digital services. Its new revenue, revenue retention, and expenditure savings. The result is inspirational and certainly every banks’ dream! Then again, organisational-wide commitment remains key. How to do so? Is it Leadership? Management? Something for you to note and think!

2. Deutsche Telekom: Revenue Loss From Fraud Reduced By Up To 20%

Deutsche Telekom’s Challenges

The prevention of network fraud is a major challenge for telecommunications companies like Deutsche Telekom. The amount of network data that needs to be collected and analyzed is enormous. Moreover, the inability to react to questionable events in near-real-time can be disastrous.

To better recognize fraud patterns, fraud analysts at Deutsche Telekom requires the ability to collect and analyze a large amount of network data. The data they amassed was stored in huge bulk. So, access and viewing data were difficult, and deemed large-scale machine learning impossible.

Deutsche Telekom’s Solutions

Using the Cloudera platform, Deutsche Telekom was able to apply artificial intelligence and machine learning. This enabled the company to detect network hitches before the clients notice them and spot fraud sequence and real-time threats; putting a stop to fraud before any business impact. Apache Impala enables analysts to look into the data quickly so they can react instantly on comprehension.

Deutsche Telekom’s Results

1. Reduced fraud and potential revenue loss:

Deutsche Telekom uses the extensive high-speed electronic data processing and interactive queries within Cloudera to enhance network quality and uncover fraudulent activities. This capability alone is estimated to reduce revenue loss from fraud by about 10 to 20 percent.

2. Greater customer satisfaction and retention in revenue:

Telekom could obtain deeper insights into the needs and wants of the customer. This allows them to effectively build campaigns that delivered results. Customer turnover is reduced by five to 10 percent.

3. Improved operational efficiencies:

With the amount and quality of rich data from Cloudera’s platform, the enterprise could move faster with automations and decision making. As a result, general operational efficiency in departments had improved by 50 percent.

3. Hilton: Centralising Organisational Data to Develop Industry-Disrupting Strategies That Deliver Higher Value to Guests

Hilton’s Challenges

Storing data in different data warehouses that utilises different technologies produces isolated and unstandardised data that does not help to reveal reliable and consistent insights. With the hospitality industry booming, Hilton too realises the importance of data to keep pace, for their customers and their business.

Hilton’s Solutions

Established the Enterprise Information Management Team who strategized five key focus areas. Installation of Hortonworks Data Platform and Hortonworks Data Flow, products of Cloudera, hosted on AWS’s cloud. The successful implementation provided Hilton not just a centralised data collection point and analytics, but also one with security, reliable management and governance across the entire cloud data platform.

Hilton’s Results

1. Real-Time Analytics Optimised Pricing That Drives Greater Revenue

A pricing that customers are willing to pay! This by itself is worthy for any serious business consideration. Yet, Cloudera’s analytics capabilities do it in real-time and little time to provide Hilton the best price they can afford to sell. Extremely useful for situational-based bookings such as when certain planned events are happening in the area.

2. Enabled Whole Lot of Opportunities with a Powerful Data Architecture Agile Enough to Support All Sorts of Deployment

Hilton understood that to grow, it requires that of their partners too! So, they wanted their franchisees to be able to access the rich real-time data on pricing, and occupancy etc. One of their ideas was a real-time dashboard powered by third-party provider that could be deployed on the agile Cloudera. Although still in conceptualisation, this is just one of many possibilities and opportunities are endless to be explored!

3. Sets a Culture for Continual Data-Driven Business Decisions Back then, any data-driven decisions were limited to each chain from a certain data warehouse. Now, Hilton’s whole organisation could use the universal data to ‘think as one’! Processes relating to their management of data need to change. But it’s a small trade-off knowing how their businesses could now benefit down the road with rich comprehensive data insights to power any decision-making right to service-line level!

4. MasterCard: Upgrades Their Anti-Fraud Solution to Support as Much as 5 Times More Customer Usage Yearly, and Sees Market Expansion

MasterCard’s Challenges

All along, MasterCard helps their financial partners evaluate their merchant risk using a database search-match system as part of their anti-fraud solution. As technology advances, this database management system that uses a relational-data model grew out of operational demands. For instance, Mastercard had to continually and manually maintain their database. For their partners, any form of search had to be done via manual keying, or bulk file import, which is time-consuming and costly. Additionally, volume of search and match were increasing with users’ needs getting complex.

MasterCard’s Solutions

Adopting Cloudera’s enterprise data hub, MasterCard were able to add more workloads and analytics functionalities to their database. Moreover, MasterCard saw the chance to use Cloudera Search, an advanced program with natural language capabilities, that was readily supported by the enterprise data hub. Now, MasterCard’s anti-fraud solution could perform complex search to derive better credit scores for their financial partners.

MasterCard’s Results

1. Supports 5 Times More Searches Annually

The revamped anti-fraud solution was able to support significantly higher number of searches annually without causing any difficulties to MasterCard’s partners. This means business sustainability for at least the next few decades and something many leading businesses will need to stay ahead.

2. Easier Searches Made Customers Search More Up to 25 Times Daily

Having the latest cloud data platform and technologies made searches much more convenient and enjoyable. Additionally, searches were faster and more precise. MasterCard could tune and optimise any search parameters to improve search performance too! Hence, the revamped anti-fraud solution supported their partners’ increased need readily while remaining flexible and adaptable to as circumstances change.

3. Having Latest Technologies Enabled New Market Expansion and Increases Revenue

An improved platform renewed confidence in expansion into new markets. Hence, MasterCard introduced their revamped solution to online marketplaces and other non-traditional customers, which created new revenue streams while opening a whole lot of other opportunities in these markets.

5. Novantas: Identified Opportunities For Banks Worth More Than $15 Million For Every $1 Billion In Deposits

Novantas’ Challenge

With the market evolving to greater demands and standards, Novantas realized that they needed to catch up with technology in order to continually deliver objectives for their financial institutions’ clients.

Similar to Deutsche Telekom, they needed a platform capable of analysing huge data sets and within a speedy timeframe. In fact, they needed real-time or near real-time. On top of, they needed a platform to analyse their call center recordings to capture insights into customer’s thoughts about their products and campaigns.

Novantas’ Solution

On Cloudera’s modern data platform, Novantas developed a self-service solution for analyzing customer journey called MetricScape. The platform merges transaction data and customer accounts from over 30 institutions with data from third parties. It also applies models of machine learning to put customer scores into use. Some examples include the customer potential value (CPV), customer retention targeting, cross-sell and upsell activities. Most importantly, the platform was able to offer optimization suggestions allowing it to constantly shape itself for maximum results.

Novantas’ Results

With Cloudera powering MetricScape, Novantas had helped its clienteles implement various initiatives more critically and profitably; namely sales, marketing, pricing, and retention. In particular, Novantas was able to help a large US bank reduce its promotional spending by fifty percent. This results in higher profit margin. With a platform capable of analytics for their mass data, Novantas were also able to derive opportunities in optimizing product prices against products. Hence achieving greater value to their clients.

6. Octo Telematics: Achieved 2x Business Growth Through Service Transformation Made Possible by Next-Gen Data Management

Octo Telematics’s Challenges

The company collects and analyzes data from connected cars to provide insurers with various insights. This allows them to constructively evaluate driver risk, offer accident and claim services, as well as oversee customer relationships.

Octo Telematics is able to utilize every type of data collected including contextual data, driving data, behavioral data, and crash data. This helps them forecast driving habits, improve crash notifications and response, evaluate crash dynamics, and detect fraud among others. Nonetheless, the growth of the company meant that they needed to upgrade themselves in order to stay at the forefront of their game. The need is for a data management platform that is scalable, and offers next generation capabilities in the Internet of Things (IoT), machine learning, and Cloud among others.

Octo Telematics’s Solutions

Octo Telematics worked with Cloudera Enterprise to operate its IoT solution. The powerful platform could now store, process, and analyze data from over 170 billion kilometers of driving. As well, about 400,000 serious accidents involving five million connected cars.

The talking point in this partnership being the insertion of more than 11 billion new data points to the platform from connected cars everyday. With data such as weather and traffic included, the Machine Learning powered Octo Telematics to understand context from each data point. This helps it derive greater accuracy in predictions and the resultant risk models.

Octo Telematics’s Results

New insights backed by accurate and reliable data, transformed the way insurers cater for their customers and created new customer experiences. Some examples include the insurers contacting the authorities in a prompt manner by being able to assess the severity of accidents, reduction in time for claim processing due to faster analyzing of liability, damage assessment etc.

A Look at a Smart Factory Powered by Cloudera

Final Comments

Cloudera’s next generation data management platform represent lots of potential for businesses in different industries to uncover. Whether be it in uncovering business opportunities, for data analytics, or in optimizing services and products, Cloudera had proved to be a sure-fire. Just check out their full list of case studies conducted by them HERE.

If you would like to find out about Cloud just for Storage, read our article Here.

Unfortunately, Cloudera’s solutions are customized solutions catered for different companies. We are unable to advise on any prices or consult further in this.

Activities

Also Read, Why NoSQL Databases are Revolutionary: Usage Cases From MongoDB

If you have any experiences with Cloudera, we are happy to hear them in the COMMENTS. I am sure the other readers would be too!

Don’t forget to LIKE and SHARE this article! Someone out there will Thank You for it!

HASHTAG #DonutAtwork